Forex manager account management experience and trading insights sharing:MAM & PAMM | Multi account managers choose carry trades and arbitrage trades for their benefits as long-term investments

Carry trades are primarily long-term investment trades based on overnight interest rate spreads. Arbitrage trades refer to earning profits by exploiting price differences among various products, markets, and locations. Carry trades are a subset of arbitrage trades. Arbitrage trades include carry trades. Carry trades are typically long-term investments, whereas arbitrage trades are usually medium-term and short-term investments. Due to the high level of Internet development and the rapid transmission speed in seconds, there is almost no price difference gap for the same variety across different markets, spaces, and exchanges. This is why arbitrage trades are becoming less common and almost disappearing, such as triangular arbitrage. There is still room for various varieties, markets, and spaces. For example, utilizing low-interest currencies to purchase bonds denominated in high-interest currencies for profitable arbitrage trades remains a viable strategy. Time is passing quickly and investment strategies must be adjusted in a timely manner to align with evolving market conditions. If you don't stick to a long-term strategy, the era of relying on a single tactic to succeed will never return.

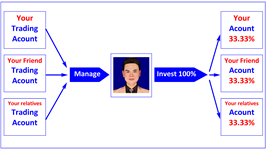

Account management experience and trading insights | Moving picture

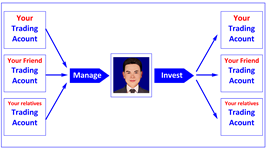

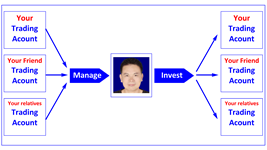

Account management experience and trading insights | Still picture

My office is near CHINA IMPORT AND EXPORT FAIR | Visit Office

Office is 2 stops away from CHINA IMPORT AND EXPORT FAIR

Office is 3km away from CHINA IMPORT AND EXPORT FAIR

Visit appointment 2 weeks in advance!

Scan Whatsapp contact me

Scan Wechat contact me